Some of the links included in this post are affiliate links. Read my disclosure policy. Rates updated as of 11/19/19

Can refinancing help when it comes to paying off student loans?

I believe it can, if done correctly. Just like anything else it will depend on your own situation.

Before getting to the top 5 student loan refinance companies I want to mention a few things that I think are important to note. And FYI I have my YouTube video linked below if you prefer to watch. Let's get to the notes.

The first thing you want to be aware of is if you truly are getting a lower rate. It might sound silly but many people don't know what their interest rate is for their current loan. Next up is to understand that going through the full process of refinancing, your credit score will be looked at. You want to be prepared by making sure there are no issues with your overall reports that can be causing a lower score.

Checking out what different companies offer is a good idea so you can be sure you're getting the best rate and deal. You lastly want to pay close attention to the benefits you might be losing when refinancing such as disability and death benefits. Not all companies will offer the same thing, so read what each company offers. Some of these companies also offer a bonus for using the link provided.

Now onto the Top 5 Student Loan refinance companies:

5. Commonbond

-Rates starting at Fixed rates from 3.21% APR to 8.16% APR Variable rates from 2.02% APR to 6.30% APR

-No early pre-payment penalty

-No fees for refinancing

-Offers forbearance if needed

-Can remove co-signer after 36 on-time payments

Sign-up with Commonbond today

4. LendKey

-Rates starting at Fixed rates from 3.49% APRVariable rates from 1.90% APR

-No early pre-payment penalty

-No fees for refinancing

-Flexible payment options

-Can remove cosigner after 12 on-time payments

Sign-up with LendKey today and get a $200 bonus

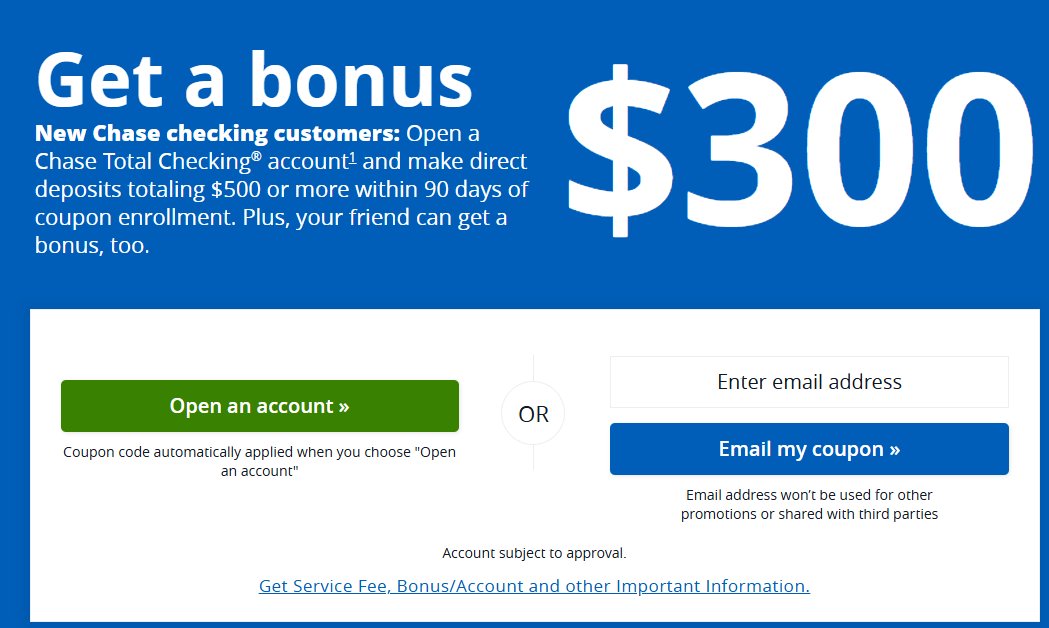

3. Splash Financial

-Rates starting at Fixed rates from 3.48% APRVariable rates from 1.99% APR

-They do soft pulls when checking your rates (and a hard inquiry when going through the full process)

-No early pre-payment penalty (this is important if you're trying to pay them off early)

-No fees for refinancing (also important)

-You want a decent credit score to get their low rates

Sign-up with Splash Financial today and get a $300 bonus if you refinance $30k or more.

2. SoFi

-Rates starting at Fixed rates from 3.49% APR to 6.67% APR (with AutoPay). Variable rates from 3.50% APR to 6.67% APR (with AutoPay)

-They will honor the first six months of any grace period (if you're still in one)

-No early pre-payment penalty

-No fees for refinancing

-$5k minimum

-Can't remove co-signer

-They offer unemployment protection

Check out SoFi today

1. Earnest

-Rates starting at Fixed rates from 3.45% APRVariable rates from 1.81% APR

-Analyzes information beyond your credit score

-No early pre-payment penalty

-No fees for refinancing

-Option to skip one payment a year (and make it up later)

-Disability or Death Discharge benefit

Sign-up with Earnest today

Check out these different companies and see which one would fit your financial situation best.

Keep in mind the rates shown are as of 11.19.19 and can change without notice. Same goes for the sign-up bonus, they can change without notice. Some of the links in this post are affiliate links and I earn a small commission at no additional expense to you.