I love the idea of saving money. One way to do so is by paying off a mortgage early (if you have one of course). I know, I know that seems like a crazy concept. Hear me out for a few moments and maybe it can help save you thousands of dollars. The idea is simple, its execution is just as simple, but the willingness.. well that's the tricky part. I believe when you plug in your own numbers it might change your mind. So what am I talking about? I'm talking about paying an extra $100 towards the principal of your mortgage every month.

What possible impact can $100 actually have in the long term of a loan? The simple answer is a lot. When I made the video below I had an extra payment calculator opened up and showed the impact $100 has on a loan. Check out the results in the video (it's a lot of money and time off the loan if you didn't guess that already).

So why $100? I don't explain it too much in the video, but the answer to why I picked $100 is because it really does impact the loan time and amount you save in interest significantly. Second, I believe that someone can either cut $100 out of their budget or work a side hustler/overtime/sell stuff every month to at least make an extra $100.

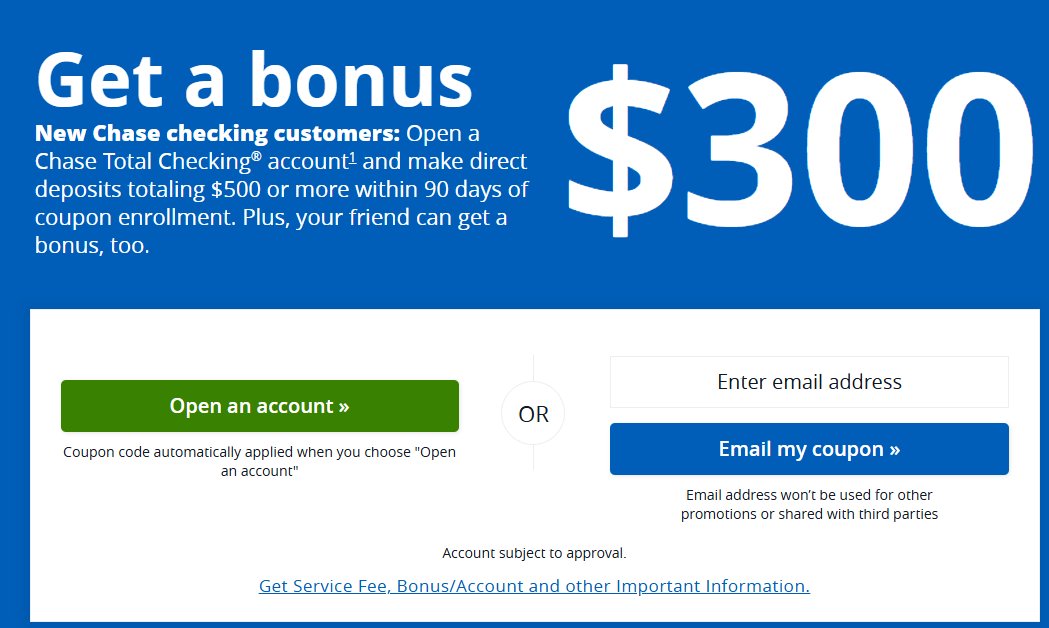

I hope you plug your numbers into the extra payment calculator that I will link here. I am not sponsored by this company. I just like their mission and love their tools, even more, to help others in their financial journey.