Chase Checking Account $300 Bonus: An Overview of Earning Rewards

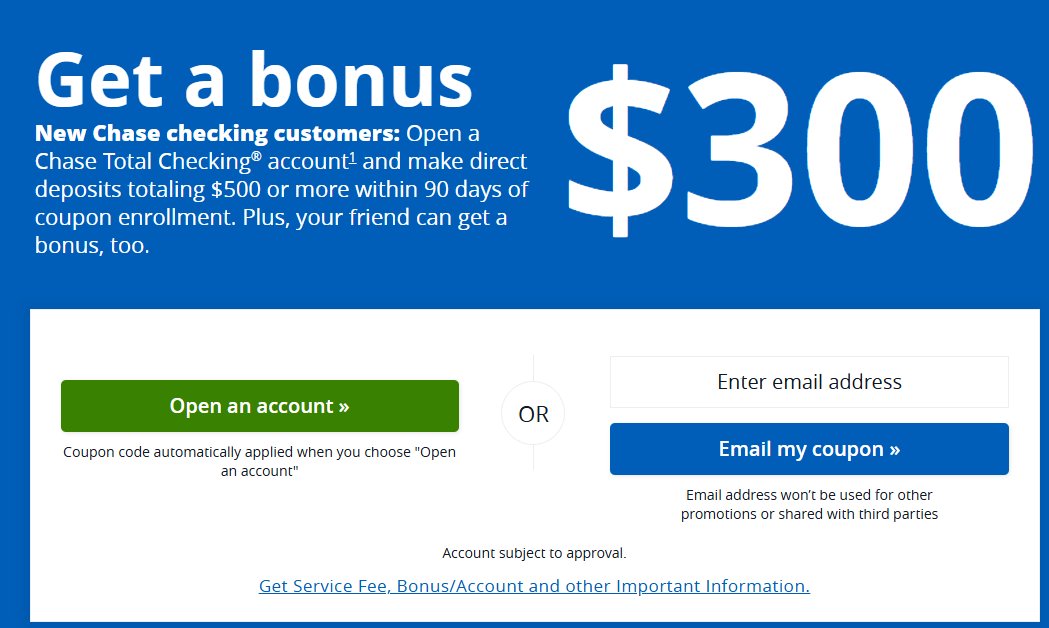

Opening a new Chase Total Checking account presents an attractive opportunity to earn a $300 bonus when you meet certain criteria. This promotion is tailored for new customers, making it an excellent option if you're looking to switch banks or start your banking journey. With simple requirements such as setting up direct deposits, you can easily secure this bonus without excessive hassle.

In addition to the financial incentive, this checking account offers various features designed to enhance your banking experience. From online banking tools to easy access to ATMs, Chase provides comprehensive support to manage your finances efficiently. You can find out more about capitalizing on this opportunity through the beneficial Refer-A-Friend Bonus program, where both you and a friend can earn rewards.

Maximizing your bonus potential involves understanding the eligibility criteria and the account opening process. Gaining insight into these aspects will ensure you fully benefit from your new account and enjoy the added rewards that come with it.

Key Takeaways

- Open a Chase Total Checking account to receive a $300 bonus.

- Meeting direct deposit requirements is essential for the bonus.

- Easy online management enhances your banking experience.

Eligibility Criteria

To qualify for the $300 bonus with a Chase Checking Account, you need to meet specific criteria. This includes having a qualifying account, being classified as a new customer, and fulfilling certain requirements for bonus eligibility.

Qualifying Accounts

To receive the bonus, you must open a Chase Total Checking® account. This account is designed for everyday banking needs and offers various features, including online banking and mobile access.

When opening your account, ensure you are applying for the right type of checking account. Other account types, such as savings or business accounts, do not qualify for the bonus.

New Customer Definition

Chase defines a new customer as someone who does not currently have an existing Chase checking account and has not had one in the last 90 days.

If you have previously held a Chase checking account but closed it before this period, you may still be eligible for the bonus. Be sure to verify your status by checking your banking history with Chase.

Requirements for Bonus

To qualify for the $300 bonus, you must make a minimum of $500 in direct deposits within the first 90 days of opening your account.

These deposits can include your salary, pension, or any other regular income. Keep in mind that transfers between accounts do not count as direct deposits.

After meeting these conditions, the bonus will typically be credited to your account within 10 business days. Be sure to monitor your account closely to confirm the bonus has been applied.

Account Opening Process

Opening a Chase Checking Account with the $300 bonus involves a straightforward process. You will submit an online application, provide necessary documentation, and await approval. Each step ensures a smooth experience while securing your new account.

Online Application

To begin your application, visit the Chase website. Click on the “Open an Account” option and select the Chase Total Checking® account account. You will need to complete an online form, which includes personal information such as your name, address, Social Security number, and date of birth.

Make sure to have an active email address, as Chase will use it for communication. It’s essential to read the terms and conditions before proceeding. When you are ready, you can also enter any promotional codes if applicable. Once submitted, you will receive a confirmation that your application is under review.

Documentation Needed

To finalize your account setup, specific documentation is required. Prepare to provide identification, such as a driver's license or state ID. You may also need to verify your Social Security number or Individual Taxpayer Identification Number (ITIN).

If you are a non-resident, be ready to present additional documents, like a visa. Additionally, have your initial deposit ready, as some accounts may require a minimum amount. Assembled documents ensure a quicker verification process.

Review and Approval

After submitting your application and documents, Chase reviews your information for completeness and accuracy. This typically takes a few minutes to several days, depending on the volume of applications.

You will receive an email regarding the status of your application. If approved, you can fund your account and start using it. In some cases, you might be asked for additional information to finalize your setup. Keep an eye on your email for timely updates about your account activation.

Maintaining Your Account

Keeping your Chase checking account in good standing involves understanding the requirements for minimum balances, account fees, and setting up direct deposits.

Minimum Balance

Chase Total Checking accounts do not require a minimum balance to avoid monthly fees, which is beneficial for those who prefer flexibility. However, maintaining a balance of at least $1,500 can help you avoid a $12 monthly service charge.

If your balance falls below this threshold, consider evaluating your spending habits. Regularly monitor your account through the Chase mobile app or online banking for easy tracking. This way, you can avoid unnecessary fees and ensure your account remains in good standing.

Account Fees

While there are few fees associated with a Chase checking account, it's important to be aware of them to manage your finances effectively. The monthly service fee is $12 unless you meet specific criteria.

- To waive the fee, you can:

- Maintain a daily balance of $1,500 or more.

- Have monthly direct deposits totaling $500 or more.

- Be a student or have an account linked to a Qualifying Chase account.

Other fees may include overdraft fees of $34 per transaction, so keep track of your spending to avoid them. Regularly reviewing your account statements can help you stay informed about any charges that may apply.

Direct Deposit Setup

Setting up direct deposit is one of the easiest ways to manage your finances with Chase. You can set up direct deposits from your employer or other payment sources, ensuring your funds are available and secure.

To get started, provide your employer with your account number and the Chase routing number. To find these, simply log into your accounts or check your checks.

You can usually expect direct deposits to hit your account on payday, often a day earlier than a traditional bank transfer. This allows you to access your funds more quickly, helping you manage your finances better.

Bonus Redemption

Redeeming your Chase Checking Account bonus involves specific steps to ensure you receive the full amount. This section covers how to claim your bonus, the timeline for receiving it, and any tax implications you should be aware of.

Claiming Your Bonus

To claim the $300 bonus for the Chase Total Checking account, you must first open an account and set up qualifying direct deposits.

- Account Opening: Complete the application process online or in-branch.

- Direct Deposits: You need to receive direct deposits totaling at least $500 within the first 90 days.

Once these requirements are met, the bonus will be credited to your account automatically. Keep an eye on your account balance to ensure you receive it.

Bonus Payout Timeline

After meeting all requirements, expect the bonus to be credited to your account within 10 business days. The process typically unfolds as follows:

- Application Confirmation: Once your new account is opened and verified.

- Direct Deposit Verification: Chase confirms your qualifying deposits.

- Bonus Credit: Funds appear in your account.

Be sure to check your account regularly during this period to confirm receipt of the bonus.

Open your Chase Total Checking® account today

Tax Implications

The $300 bonus is considered taxable income. This means:

- IRS Reporting: Chase will issue a 1099-INT form if your interest and bonus total more than $10 in a given tax year.

- Tax Returns: You should report this bonus income when filing your tax return.

It's essential to keep records of this bonus for tax purposes to avoid any surprises during the tax season. Always consider consulting a tax professional for personalized advice regarding your financial situation.

Frequently Asked Questions

This section provides clear answers to common inquiries regarding the Chase checking account $300 bonus. Understanding the eligibility, timelines, and specific requirements can help you navigate the process smoothly.

What are the eligibility requirements for obtaining the Chase checking account bonus?

To qualify for the $300 bonus, you must be a new customer opening a Chase Total Checking® account. You also need to make direct deposits totaling $500 or more within the first 90 days of account opening.

How long does it take to receive the $300 after meeting the Chase account bonus criteria?

Once you meet the deposit requirements, the $300 bonus will typically be credited to your account within 10 business days. Make sure to check your account statements to confirm receipt.

What steps must be followed to qualify for the Chase checking account promotional bonus?

First, open a Chase Total Checking® account online or in-branch. Then make direct deposits of $500 or more within 90 days. Keep track of your deposits to ensure you meet the criteria.

Are there special codes needed to activate the Chase checking account bonus offer?

You typically do not need a special code to activate the bonus offer. Simply follow the standard account opening procedures, and the offer should apply automatically.

Is there a deadline to apply for the Chase checking account bonus to ensure the $300 reward?

Yes, there is usually a deadline for applications related to specific bonus offers. Check the Chase website for details, as deadlines can vary based on promotional periods.

Can the Chase checking account bonus be combined with other saving account offers?

Generally, the checking account bonus cannot be combined with other promotional bonuses for savings accounts. Confirm specific offer details on the Chase website or with a representative for clarity.